What’s in a Financial Plan?

Meet Ben & Courtney

(They don’t actually exist, but their goals and our subsequent financial analyses and conversations reflect those of my broader clientele)

Their Situation

Age: 35

Occupation: Product Manager; Series C private company

Salary: $175,000 per year

Equity: Has ISOs and NSOs

Debt: ~$52,000 in student loans

Ben

Age: 33

Occupation: Designer at Apple (AAPL)

Salary: $225,000 + annual “refresh grant” RSUs

Equity: Vests each month into Apple RSU shares

Courtney

Recently married and looking to consolidate finances and accounts across various custodians

Each have legacy 401(k)s from old employers that are floating around the ether

Other Details

Their Primary Goals & Questions

“We are currently renting – but would like to buy a house within the next few years”

“We’d like to start having kids in a year or so! Ideally, 2-3 kids. How should we be planning?”

“We make good money…but where does all of it go each month?”

“Ben’s company is likely going to IPO soon. Should he exercise the rest of his NSOs?”

Financial Plan Overview

During our onboarding meetings, I learn more about Ben and Courtney’s current financial situation.

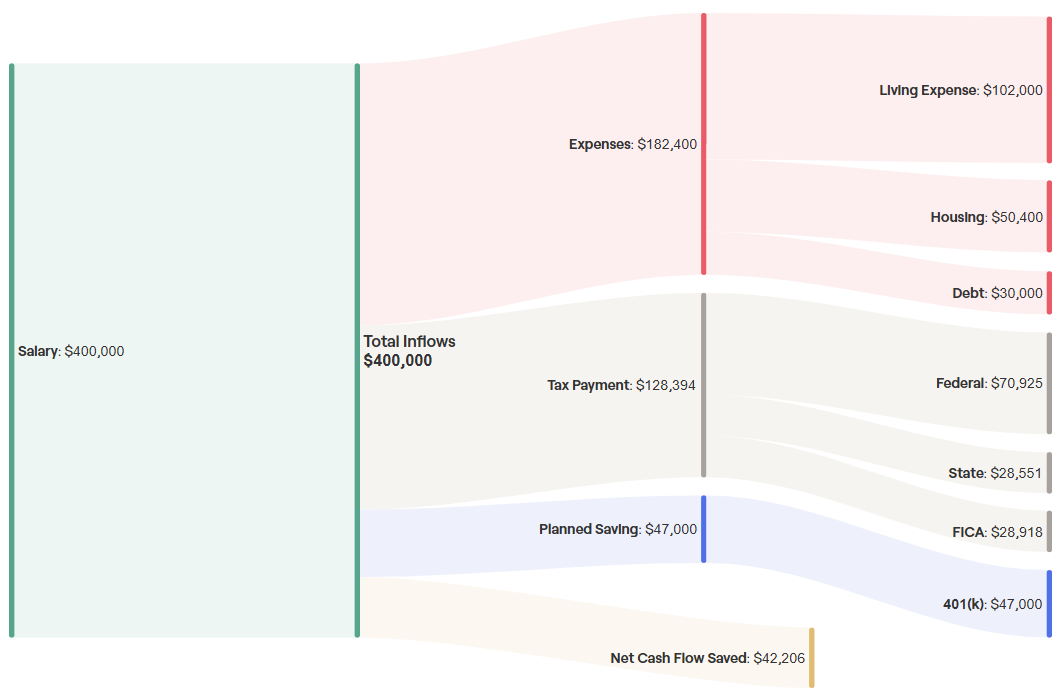

Ben & Courtney | Current-Year Cash Flows

Ben & Courtney | Current-Year Balance Sheet

5-Year Cash Flow Projections

Given that Ben and Courtney want to have kids and buy a house — both of which are often incremental expenses — it’s important to model the cash flow implications over the next few years.

Housing Affordability & Buy vs. Rent Analysis

Ben and Courtney are interested in buying a house. But they‘d like clarity on how much house they can afford and whether they should rent or buy. We’ll look at the quantitative analyses and combine that with their qualitative desires so that they can make a holistic decision.

Ben and Courtney are looking at a $1.2M home. However, even with household income of $400,000 and a downpayment of $240,000, cash flows would be tight when factoring in federal/state/FICA taxes + other housing costs. Levers can be pulled to lower discretionary expenses, but Ben and Courtney will ultimately have to decide if they are comfortable with the fixed costs.

Ben and Courtney decide that the initial $1.2M home is too much fixed cost and not enough flexibility. They are now considering a slightly less expensive purchase — but now wondering if it makes more sense to rent or buy. We use this analysis to look at some of the key factors: 1) How long do they plan on staying in the house? 2) What rate of return could they get if they didn't sink that cash into your home? and 3) How much will their home appreciate over the next X years?

NSO Exercise vs. Hold - Probability Analysis

Ben would ideally like to exercise his NSOs now but is wondering if that’s a good idea or not. How much tax will he owe? Can they afford it? At what opportunity cost? How much will this save them in taxes upon anticipated IPO? We run a probability analysis to understand some initial numbers.

AMT Impact of Exercising Additional ISOs

Ben is also curious about the impact of exercising an additional tranche of incentive stock options — on both the total AMT due and total tax liability for the upcoming year. Using sophisticated tax software, we model this scenario while also looking at what happens if additional NSOs are exercised in conjunction with the ISOs.

1099-B Tax Analysis To Find Missing RSU Cost Bases

Courtney sold some Apple RSU shares this year. We always review tax returns and, in analyzing her 1099-B, it becomes apparent that the custodian did not properly list her cost bases. Had this not been caught, Courtney would have been double-taxed on the sale proceeds!

Healthcare Benefits Decisioning

Ben and Courtney have questions about the which healthcare plan they should choose during open enrollment. We run an analysis and consider their tax rates, embedded deductibles, out-of-pocket maximums, and contribution rates to various tax-deferred accounts.

Adding a $1M “Umbrella” Policy

The reality is that we live in a highly litigious society. My job as a financial planner is to not only help grow your assets, but to ensure that your assets are protected from catastrophe. It only takes 1 frivolous lawsuit (e.g. spilling hot coffee on someone who then sues you for $750,000 in damages) to destroy an entire plan. Umbrella policies are often cheap — and their value cannot be understated. Here’s what a $1M policy could look like for Ben and Courtney.

Important: Presidio Advisors never sells insurance or receives any commissions or other forms of compensation from recommendation any particular policy.

Term Life Insurance Policy Review

In anticipation of having kids, Ben (smartly) decided to purchase a term life insurance policy. In reviewing the policy details, however, it becomes apparent that this particular policy is not “level term”. This means that his premiums are going to increase — dramatically — over the coming years. Since I don’t sell insurance, I instead refer Ben to a neutral, third-party broker that can help write a level, fixed-premium term life insurance at a much lower cost.

Important: Presidio Advisors never sells insurance or receives any commissions or other forms of compensation from recommendation any particular policy.

Education on Estate Planning

As the saying goes, “nothing is certain but death and taxes.” As morbid as it may be, it’s important for my clients to have proper estate plans in place to as to avoid probate, ensure privacy, and reduce the burden and cost on loved ones. I am not a licensed attorney, but I do provide resources to my clients to help expedite basic planning needs such as: revocable trusts, wills, powers of attorney, advanced healthcare directives, etc.

Next Steps: